ST. LOUIS ‚Äî A lawsuit filed Monday seeks class action status to recoup the 1% city earnings tax paid by employees who worked outside ◊Ó–¬–”∞…‘≠¥¥, a liability that could run well into the millions due to the large number of people who worked from home during the pandemic.

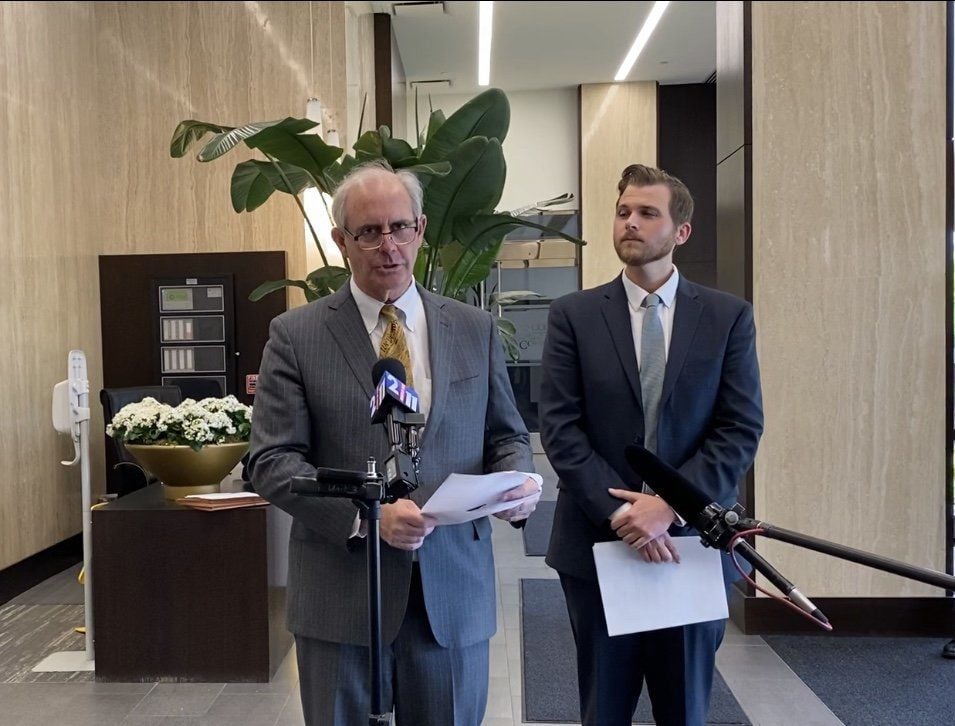

The lawsuit was not unexpected. Bevis Schock, the attorney who filed it, said last year that he planned a class-action lawsuit after Collector of Revenue issued a policy that barred city earnings tax refunds for employees working outside the city limits.

In past years, ◊Ó–¬–”∞…‘≠¥¥ has allowed refunds to employees for days they traveled and worked outside city limits, issuing about $2.9 million in refunds to an estimated 4,000 people in the year before the pandemic. But that changed this year as thousands worked from home to slow the spread of the coronavirus, particularly white-collar office workers who had been concentrated in employment districts such as downtown.

People are also reading…

“This is a whole different set of circumstances,” Daly told the Post-Dispatch in June. “The way we view it, you and your company have agreed (to have you) work at home. You’re still utilizing all the computer software that your company provides” from its base in the city.

More than one-third of the city’s general revenue comes from the 1% earnings tax charged to city residents and nonresidents who work in the city, or about $180 million last year. The lawsuit cites an estimate that 75% of earnings tax revenue come from nonresidents.

The lawsuit, filed in federal court in ◊Ó–¬–”∞…‘≠¥¥, lists plaintiffs Mark Boles of ◊Ó–¬–”∞…‘≠¥¥ County and Nicholas Oar and Kos Semonski of St. Charles County. Boles and Semonski submitted refund applications this year for remote work, as they had done in past years, but the collector‚Äôs office denied their claims, according to the lawsuit. A collector‚Äôs office employee told Boles the office‚Äôs policy had changed in January 2020, according to the lawsuit.

Oar provided documentation that his computer network is based in Minneapolis, yet the collector’s office still denied his request for a refund, the lawsuit says.

A city spokesman declined to comment because city attorneys haven’t yet reviewed the lawsuit and don’t comment on pending litigation.

Schock has fought the city and state before. His biggest recent win shut down red-light cameras in much of the state after 2015 Missouri Supreme Court rulings altered rules on their use. He also filed suit to block stay-at-home orders in ◊Ó–¬–”∞…‘≠¥¥ and ◊Ó–¬–”∞…‘≠¥¥ County at the outset of the pandemic, though judges have given local leaders wide discretion to enforce health orders.

The lawsuit seeks a declaration that the city cannot collect earnings tax revenue from employees when they work outside the city limits, as well as refunds and attorney fees.

It’s the latest threat to one of the city’s biggest revenue streams. Voters will decide April 6 whether to reauthorize it, a vote residents must take every five years under a 2010 law passed by state voters.

Jacob Barker • 314-340-8291 @jacobbarker on Twitter jbarker@post-dispatch.com